Capterra published its findings on cloud POS market share growth in March 2016. Admittedly, we at WhatsBusy are a little behind on analyzing their results; but that doesn’t mean they aren’t worth examining today! In 2016 we prognosticated that the majority (50%) of POS systems on the market would be in the cloud within five years. Capterra’s survey seems to indicate this is happening even faster.

The survey was based on 400 responses. It’s not a ton, but it’s not nothing, either. Capterra did a decent job in segmenting responders into categories and cohorts. There are behavioral biases based on how questions are presented; but since I was not the one crafting the survey questions, I cannot confirm that some form of chuting wasn’t employed.

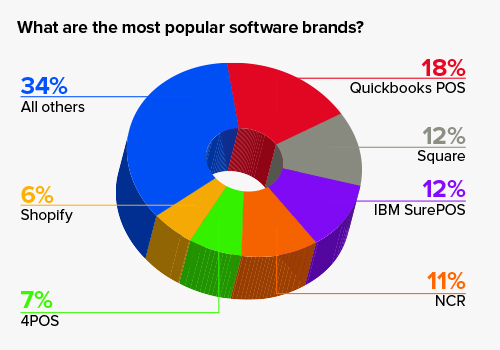

First, as much as Micros and NCR love to beat their chests about owning the POS software market, only the latter showed up as a meaningful result. Even more surprising was that Square commanded higher responses than NCR. Sure, the merchants that Square serves are mostly the farmer’s market variety; but the company was founded only six years ago—and so if it has already eclipsed NCR’s footprint, that would be very impressive!

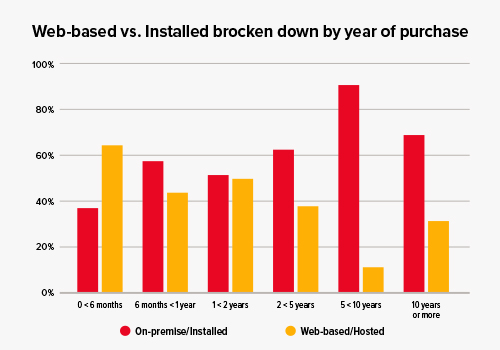

Capterra also asked if merchants preferred on-premise server systems to cloud systems. While the scales tipped in favor of the former (57% to 43% on the aggregate), that’s not the whole story.

The average merchant is in business for 30 months (2.5 years). So, if 25% of the market is composed of new entrants annually (due to churn of previous merchants), then many new merchants are in the market for new POS systems. In examining the trend of respondents, we saw that newer merchants prefer cloud systems (62%) to on-premise systems (38%). Therefore, every year 15.5% (62% of new merchants who prefer cloud POS x 25% new merchants) of the POS market is being moved to the cloud. Over 5 years that works out to 77.5% (15.5% x 5).

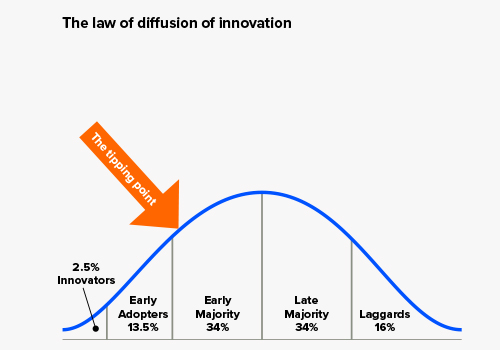

Yes, some of these new entrants will undoubtedly be part of that 25% that go out of business, and still others will inherit legacy systems. But even if we conservatively account for that degradation factor, we’re still above 50% of the market. Examining the failure rates of chain restaurants versus independents reveals that even established businesses are no more immune to failure in this vertical. At any rate, the cloud POS adoption curve far surpasses the 15% market penetration needed to ensure new ideas become mainstream, as laid out in the law of diffusion of innovation.

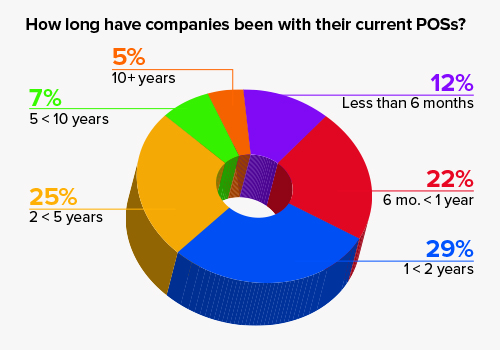

Further supporting this math is market upheaval: 88% of merchants have owned their POS for no more than five years, while a full 63% have been with their current POS for less than two. This is to be expected as larger companies, which are less prone to going under than are small operators, have a lot invested in their current POS architecture. It is the brain stem for all their operations, marketing, and accounting—and multiple layers of bureaucratic politics are at work to keep existing tools entrenched.

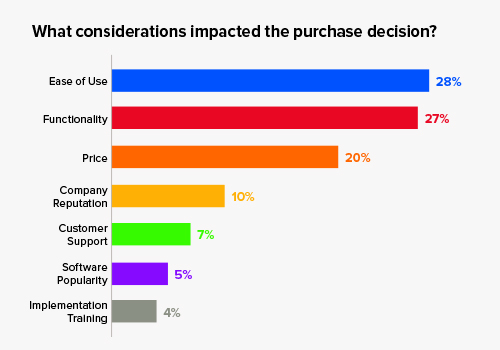

It’s intriguing, though, to examine how merchants are making POS purchasing decisions.

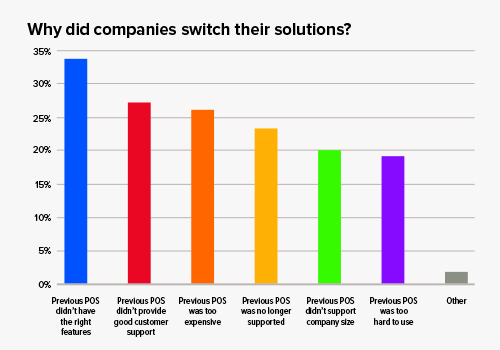

The first point we took into consideration was POS features. What do you think happens when the features that matter the most—enabling merchants to sell goods online; letting merchants choose delivery services, update menus, inventory, and pricing; and connecting merchants with best-of-breed third-party services—are those of connectivity? And what happens when legacy POS systems cannot provide these connections without clunky middleware that costs more than a new POS system? If you need to pay an extra $50 per month just to connect your local POS server to services where customers can find you, it makes sense to get a new POS system quickly.

Second was customer support issues. For most legacy POS providers, this local support was provided by an army of resellers. Many resellers talked merchants into enrolling in a particular POS—which was great for the reseller, who won their lucrative credit card processing business and then happily collected payment residuals; but the merchant was stuck with a provider who either didn’t offer adequate support or, in some cases, ever talk to them again. Cloud POS, as we’ve mentioned, enables much of the support to be handled remotely, since there are regular system updates feeding into headquarters.

Third, many merchants thought POS systems were too expensive. We’ve talked about that, too; and as cloud POS is dropping prices on hardware, software, and services across the board, POS has become more affordable for small merchants who had previously shunned the upgrade.

Fourth is that some POSs are no longer being supported. Sounds a lot like Micros customers who have been abandoned as Oracle focuses on enterprise accounts. Looking at the survey results, it’s fair to conjecture that it won’t be too long before NCR takes the same approach.

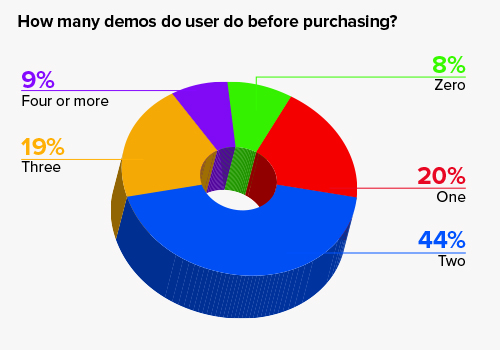

Even more damning to the legacy business model is that a growing number of merchants are buying their POS directly online without a demo. This is likely following industry consumer trends: 25% of consumer electronics are being purchased directly online.

Lastly, the purchasing considerations merchants identified on the survey are not good news to large incumbents with big name brands. Following the chart we posted earlier, newer technologies have a big leg up on the incumbents. Three factors—ease of use (new user interface design from cloud companies), functionality (the functionality of connectivity trumps all), and price (cloud POS is cheaper)—accounted for 75% of the weight of a purchase decision.

Customer support (which can improve drastically with cloud POS) and implementation training (which is less important as the software becomes easier to use and as libraries of online tutorials proliferate) account for about another 11%—leaving cloud POS with the advantage in all but 15% of the categories that really matter.

In a final coup de grâce, Intuit published its own findings with help from a report by GrowthPraxis: “A report by GrowthPraxis revealed that the mPOS market is growing in the U.S. at a rate of 9.2%, while conventional POS sales are shrinking at a rate of -2.5%. By 2018, the installed base for mPOS is forecasted to be larger than the installed base of POS terminals worldwide.”

Along with this news is Hospitality Technology’s findings that 52% of merchants are considering cloud POS for their next upgrade, up from 38% in 2012; and a Business Intelligence’s report showing that mPOS devices are projected to triple to 27.7 million deployments through 2021.

These figures are tough to hear for legacy POS providers who refuse to invest in modernizing their own systems and/or refuse to make other necessary investments in their businesses that would help them to stay relevant. So, 2017 is likely to end up as a year marked by a sobering lesson in market forces for many who have been too content to stay put for too long.

This article originally appeared on the Reforming Retail website: http://reformingretail.com/index.php/2017/01/09/data-that-proves-cloud-pos-migration-is-happening-faster-than-believed/

Jordan Thaeler is president and co-founder of WhatsBusy, a big data analytics startup that publicly forecasts when places are busy. Prior to WhatsBusy, Jordan was at Amyris through IPO, and has spent time in finance and regulatory affairs. Jordan is an engineer by training but is always the last person to figure something out . . . that’s why he asks so many questions.