By: Cort Ouzts, CEO of POS Nation

By now, you’ve undoubtedly heard the benefits of converting your business to a recurring revenue model. If you’ve read this publication, attended RetailNOW, or even listened to a Jim Roddy podcast, you know RSPA has evangelized this movement to help VARs and ISVs survive in today’s competitive market.

Most of the benefits of the recurring revenue model that you’ve heard, however, focus on the operational side of the business: predictable and stable cash flow, insulation from economic cycles, and ultimately increased profits. This article, is not about any of those merits. Instead, I’d like to focus solely on the often-overlooked impact that a recurring revenue model has on your business’ valuation.

Business Valuation: The Setup

Business valuation is one of the more delicate — and misunderstood — topics for business owners. I began my career as an investment banker, so I’d at least like to think I have more M&A experience than the average point of sale guy. For my analysis, I’m going to make several assumptions. If you don’t think my assumptions are accurate, I won’t argue with you, but I don’t believe any of my assumptions are so outlandish that they change the key concepts.

For simplicity in our analysis and to avoid the complications of intellectual property valuation, let’s just focus on VARs. Let’s also focus on small VARs because it’s easier to illustrate my point. What’s a small VAR? I’m not exactly sure, but from a valuation standpoint, businesses with less than $5M in sales and $1M in EBITDA (earnings before interest, taxes, depreciation, and amortization) are just viewed differently, so we’ll use that as our small business benchmark.

Business Valuation: A Rude Awakening

If you’re a small business, valuation is tough, but here’s a good rule: add up all of your non-recurring sales from the last 12 months. This sum should include sales from hardware, software, supplies, and any project-based work. Now, multiply that number by zero. That’s how much an outsider will pay for that portion of your business. Let that sink in.

I know what you’re thinking, but I’m sorry — that’s just the reality, and here’s why. At a small business, the risks of having to go win new business every day just to eat are scary. If one thing goes wrong, from a lost customer or an employee unexpectedly quitting to a bad sales month or an unwelcomed lawsuit, you’re in trouble. The business is too lumpy and too hard to forecast. The sales machine just doesn’t exist yet for an outside investor to be comfortable that new sales are systematically and predictably coming in the door each month. And don’t underestimate how significant key-man risk is if you plan on selling your business and retiring. As an outsider, I have no interest in writing you a check so that you can go buy a beach house, only to see all the business’ customers leave and all the leads dry up because you are no longer there.

So back to my point: the transactional side of your business is effectively worthless to an outside investor. You can argue about multiples all day long, but I’m just telling you, an academic exercise in valuation is meaningless unless someone is willing to write that check. And the honest truth is, you’re going to be hard-pressed to find that guy willing to invest in a small transactional-based business.

Very Different Risk Profiles

Right now, you’re probably thinking. okay, for the sake of argument, I’ll begrudgingly accept your stance on the transactional side of the business. However, all those risks you previously mentioned still exist in a small VAR that does embrace the recurring revenue model. True. Absolutely right. The operational risks are the same, but the financial risks are vastly different. A VAR with a base of recurring revenue isn’t dependent on the next sale to survive. The risk of the business going to zero is very low because there’s already a stable base of cash flow. Even if the business completely failed after the acquisition, the acquirer would still be able to recoup some of the investment as recurring revenue continued to trickle in. The risk profile is completely different, and the risk-reward equation is what drives logical financial decisions.

Two Different Scenarios: What the Numbers Say

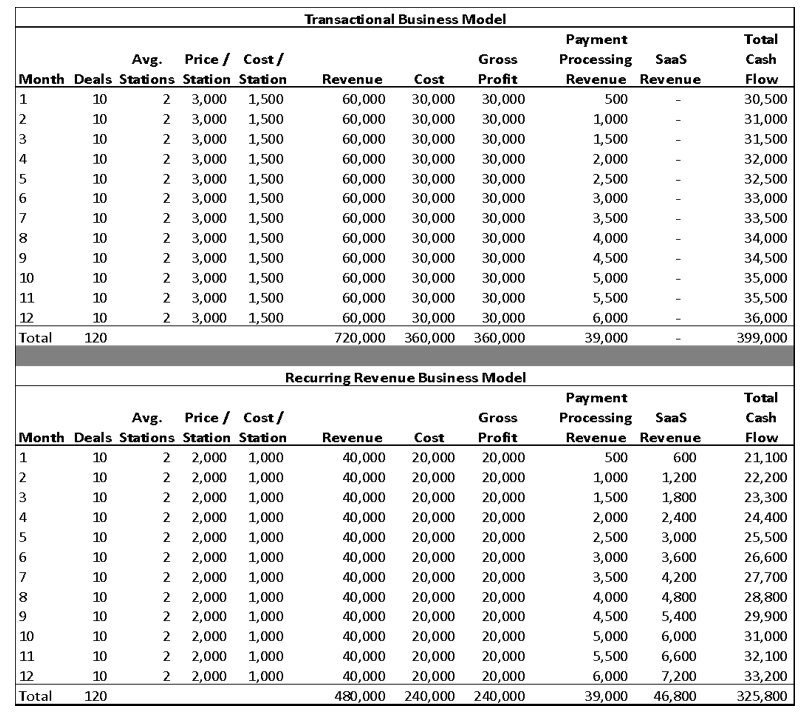

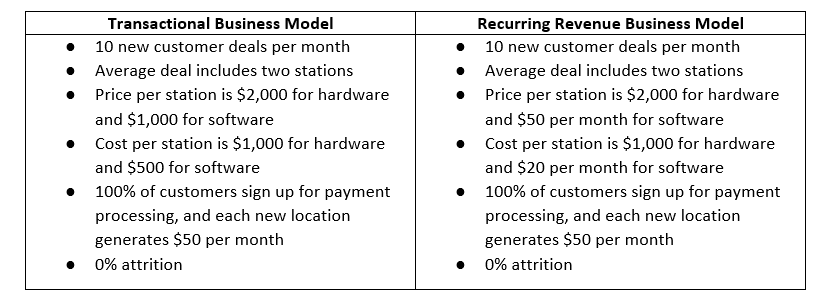

Now that we’ve painted a picture of two scenarios involving VARs with different business models, let’s put some numbers behind them. I know the most common argument against the recurring revenue model is the hit to cash flow as your business makes this transition. That’s a legitimate concern, but let’s see how it plays out when we factor in exit value. For our analysis, we’ll again assume that a potential acquirer isn’t putting any value on the transactional side of the business. (Again, I’m sorry, but it’s the reality.) Our other assumptions are: For the transactional business model, the company brought in 120 new customers generating $360,000 in gross profit from those sales. Adding in payment processing revenue, the company generates $399,000 in gross profit.I think by now all VARs offer payment processing, so even in the transactional business model example, we’ll assume that the business is generating some residual income. The chart illustrates a year of operations for the transactional business model compared to the recurring revenue business model.

For the transactional business model, the company brought in 120 new customers generating $360,000 in gross profit from those sales. Adding in payment processing revenue, the company generates $399,000 in gross profit.I think by now all VARs offer payment processing, so even in the transactional business model example, we’ll assume that the business is generating some residual income. The chart illustrates a year of operations for the transactional business model compared to the recurring revenue business model.

In the recurring revenue scenario, the upfront purchase price of each station is reduced to account for the SaaS license instead of the one-time, perpetual license. Again, the company brought in 120 new customers, but in this scenario, the company sales generated only $240,000 in gross profit. Once we add in the payment processing and SaaS revenue, this company generates $325,800 in total gross profit.

‘Wait!’ you say: $325k is way less than $399k! Yes, it is, but our analysis isn’t complete. We have to take into account the value of the business after 12 months as well. In both scenarios, let’s assume for simplicity, all monthly recurring revenue is valued at a 30x multiple. In the transactional scenario, the business, in month 12, is generating $6,000 per month in payment processing revenue, which equates to a value of $180,000. Taken together, you’ve generated $579,000 of value in 12 months in this scenario.

In the recurring revenue scenario, the business, in month 12, is generating $13,200 per month in recurring revenue, which equates to a value of $396,000. Taken together, you’ve generated $721,800 of value in 12 months in this scenario. That’s $142,800 more value creation than the transactional scenario.

If You Remember One Thing…

Completely disregarding any of the operational benefits of the recurring revenue model, the potential impact this model can have on your business’ value should be enough to convert even the most ardent transactional business follower. Business valuation is a tough topic for many business owners, and more often than not, the emotional side of owning and growing a business blinds owners from reality. I’m sure you can find advisors, accountants, brokers, blogs, and textbooks that’ll all disagree with the principles I’ve laid out in my analysis, but unless one of those guys is willing to cut you that check, it’s all paper profits that don’t amount to much.