By: RSPA STS Committee

What a year to remember (or forget)! Retail technology had a mixed year, with some technologies taking great leaps forward while other once-promising technologies had delayed adoption due to changing priorities caused by the pandemic. Will market trends and conditions snap back to the way they were in 2019, or has the market permanently changed? Last year when we surveyed the STS Committee, the members were very precedent, projecting increasing adoption for mobile wallets, contactless payments, online ordering and self-check-out. Pretty spot-on given what happened with COVID. A year later, we surveyed the team again to learn what they see on the horizon for 2021 and beyond.

- What was the coolest new technology that you saw in 2020?

Mark Bunney: PIN on Mobile and Tap on Phone with commercial off-the-shelf smartphones, tablets or other devices. While these solutions are still very new in the market, the ability to use any device to take payments will not only help the smaller merchant in a retail store when the consumer wants to pay at the point of interaction but also offer a more seamless experience.

Larry Fandel: Technology to enable non-touch input on video screens via cell phone, gesturing and projected keypad for devices such as kiosks. Such technology obviates the need to touch a kiosk.

David Gosman: There are a few new start-up companies on the market offering “checkout-free checkout,”” powered by computer vision and artificial intelligence. This is similar to what you’d see in the Amazon Go store — you walk in, scan or swipe your loyalty code or payment card and then shop for your products as you normally would. When you are all done, just walk out of the store, and the system charges you for what you picked up. The experience is euphoric vs. the experience during a typical checkout process and should scale in adoption as costs come down.

John Gunn: Paper-thin Bluetooth tags that are powered via Wi-Fi. The tags are tuned to absorb power from a specific frequency of Wi-Fi waves (but not all Wi-Fi frequencies). I predict this technology will have substantial growth potential once it is available commercially.

- What emerging technology was most impacted negatively by COVID?

Kyle Lauber: I believe that the kiosk market took the biggest hit during COVID-19. Instead of risking the spread of germs from touching screens on self-serve kiosks, we saw customers preferring to talk to employees face to face. Customers also increasingly used their cell phones whenever possible for mobile transactions such as ticketing and reservations.

Uwe von Sehrwald: I really did not see a negative impact on anything in the grocery market. Grocery sales exploded as the shutdown forced people back into stores from restaurants. Some IT projects were deferred in favor of getting the store in “COVID mode.” Traditional POS was not a focus, but many grocers invested in projects that expanded their POS systems, such as online shopping, mobile shopping, self-scan and self-checkout. At the POS station, retailers installed plexiglass and PIN pad covers, etc. to provide protection to customers and employees alike.

John Gunn: Anything touch seems to have been impacted negatively in favor of contactless, and I know of at least one payment provider who was NOT ready and is paying the price (no pun intended). The aftermarket mounting systems for tablets were also impacted, like kiosks for public terminals.

Kevin Kogler: Any emerging technology focused on improving the in-store shopping experience was negatively impacted. Just last year, we were talking about “endless aisle”kiosks allowing customers to order items not in stock, smart mirrors in changing rooms that allow customers to try on items virtually and mobile POS tablets that allow employees to work collaboratively with customers on the sales floor. All of these have been pushed to the side with COVID-19

- What technologies and services surprisingly benefited from the pandemic?

Ken Andrews: We saw an initial burst in customers looking for remote access solutions as they shifted some of their workforces to working remotely. That has slowed down considerably but was a big push during the first month of the lockdowns.

Larry Fandel: We saw the fanless design of retail hardware become more popular. Not only does it increase hardware life, but it also prevents pathogens from being sucked into the POS or kiosk and then exhausted to an unsuspecting customer and/or associate. There has also been a marked increase in ruggedized tablet sales.

Mark Bunney: Contactless payments has seen a much higher usage rate in the U.S. than originally expected in 2020. While the percent of transactions is still small, the consumer awareness and willingness to use a contactless card or smartphone will set the stage for much higher growth and utilization in the coming years.

Kyle Lauber: Obviously, the pandemic forced some businesses to adjust their daily activities. At Star Micronics, we saw a spike in the interest in our cloud technologies. The technology was being applied in the hospitality environment to offer a better experience for customers during online ordering or curbside pickup. These services are becoming more and more common and do not show any signs of going away. In fact, they are almost required now for businesses to operate.

- How will the retail customer experience change in 2021?

Uwe von Sehrwald: I predict growth in technology and solutions that provide a clean environment where there are touchpoints and interaction. For example, one area where I see growth is in attaching UV lighting to touch screens, PIN pads, and kiosks. This is new but seems to be gaining steam.

Mark Bunney: Mobile and self-service solutions continue to generate high interest from many retailers. Retailers are thinking of new ways and use cases to engage with the consumer – and these solutions help with the engagement with the consumer anywhere in or outside of the store.

John Gunn: Despite all the focus on this in recent years, omnichannel didn’t actually exist for most retailers before the pandemic. But COVID has forced retailers to knit together online and offline worlds in substantial ways. Retailers that survive will focus on improving the customer experience with more personalization. Digital signage, in conjunction with sensors, will change the curbside pickup experience. Personalized upselling based on understanding the customer habits/desires and associated purchases will happen in-store, much like we see in e-commerce today.

Kyle Lauber: Customers can expect to see more sneeze guards or protective shields at the point of sale, limits on the number of customers allowed in the store and even in some cases, the number of employees available to help customers in the store.

Ken Andrews: We expect to see a continued push for online ordering along with curbside pickup and delivery options. While delivery numbers are down now from the peak, it appears that a significant number of customers have embraced this option and are keeping it even after lockdowns have loosened.

- How will the Retail IT channel need to adapt to the market post-COVID?

John Gunn: Retail IT channel leaders will learn to adapt to offering recommendations that consider safety, frictionless solutions, contactless solutions, and personalization to a greater degree that works in the post-COVID world but is prepared for the inevitable next pandemic. You can see the difference in retailers who were already working for the future vs. those that have not and have not been able to adapt. It is no different with the IT solution providers.

Ken Andrews: The focus on security will need to be increased due to the larger number of employees working remotely. Remote workers significantly increase an organization’s security exposure by adding numerous endpoints that are often on loosely protected home networks.

Uwe von Sehrwald: There will be a continued need to develop more expertise in self-checkout and ways to create less friction at the point of sale. Frictionless checkout has become a requirement during COVID and will continue post-COVID. Self-checkout was historically driven by saving labor costs. But it has now turned into a solution for social distancing and to fill a hole caused by retailers not being able to source labor.

- What technologies are you keeping your eye on for 2021 and beyond?

Kevin Kogler: QR technology for payments may take off in 2021. Apple is rumored to be working on a feature in its Wallet app to allow iPhone users to make payments by scanning a QR code. The new method would no longer require a connection with a traditional payment terminal using near-field communication (NFC). Instead, iPhone users could pay anytime, anywhere using a credit card stored in the Wallet app just by scanning a QR or a traditional barcode with an iPhone camera. The Wallet app would perform the transaction with Apple Pay’s servers over its cell network, bypassing the payment terminal. This payment method is widely used in Asia but has not yet caught on in the U.S.

David Gosman: Drones have been one of the beneficiaries of the pandemic. You’re probably thinking, “I haven’t seen a single instance of a drone delivering a product!” Outside of controlled tests, you’d be correct! However, the interest in this futuristic technology hasn’t been limited to consumers — governmental regulatory agencies have been increasingly supportive (read: faster and more flexible) of this method of touch-free delivery of goods. I believe this has put last-mile deliveries, powered by drones, on the fast track for near-future usage.

Ken Andrews: We are keeping a close eye on options to tightly integrate e-commerce for grocery with the delivery process. There appears to be a lot of opportunity in this space, although it is highly competitive, and delivery companies have historically had a hard time turning a profit.

Uwe von Sehrwald: Self-checkout improvements that lead to less fraud. We are starting to see cameras and item recognition on self-checkout to reduce the amount of fraud occurring. For example, if a customer enters 4011 for bananas and the camera/imager sees a wine bottle, the self-check-out system will recognize the inconsistency and not allow the customer to proceed without intervention.

Mark Bunney: Biometrics and facial recognition will be an interesting technology and solution to watch in the market. This has the potential of improving the consumer experience around payment and loyalty with verification while providing a safer and “contactless” engagement with the merchant. The adoption will not only be dependent on new technologies but also privacy implications of the consumer having their picture taken during a transaction.

John Gunn: Asset tracking systems cheap enough for tagging individual products with inexpensive RF price labels (pennies per tag) that will allow a retailer to electronically track the quantity, location and even temperature of inventory items across all locations. This will greatly simplify keeping shelves stocked and products flowing and provide real-time, accurate data to the retailer and its distributors.

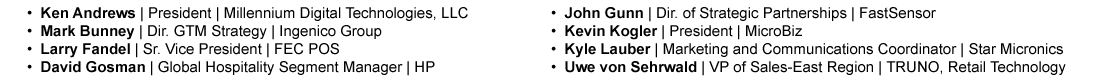

Contributors: